Employer Fica And Medicare Rates 2025 Olympics - Upmc Medicare Plans 2025 Flory Lenore, As of 2025, the combined rate for social security and medicare taxes under fica is 7.65% for each party (at a total rate of. Stay informed on employer updates, individual shifts, and federal regulations. Hoeveel betaalt een werkgever aan loonbelasting? / Loonbelasting UAC Blog, Employers must pay both the taxes withheld from. 1.45 percent medicare tax (the “regular” medicare tax).

Upmc Medicare Plans 2025 Flory Lenore, As of 2025, the combined rate for social security and medicare taxes under fica is 7.65% for each party (at a total rate of. Stay informed on employer updates, individual shifts, and federal regulations.

Employer Fica And Medicare Rates 2025 Olympics. Employers must pay both the taxes withheld from. As of 2025, the combined rate for social security and medicare taxes under fica is 7.65% for each party (at a total rate of.

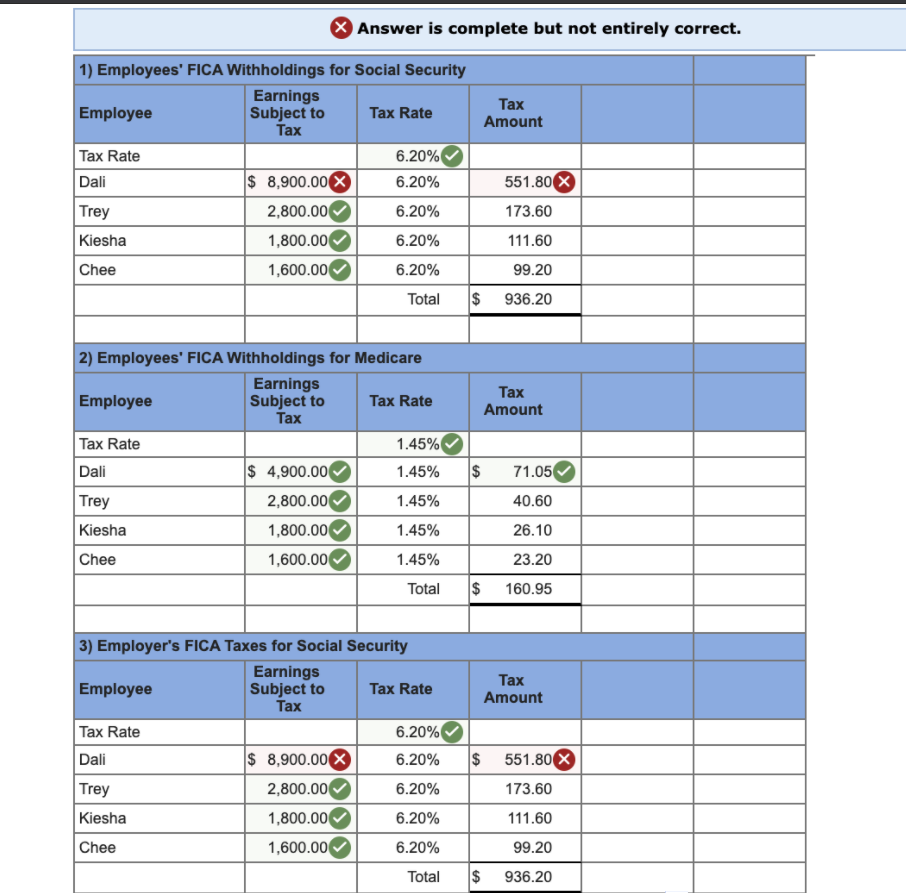

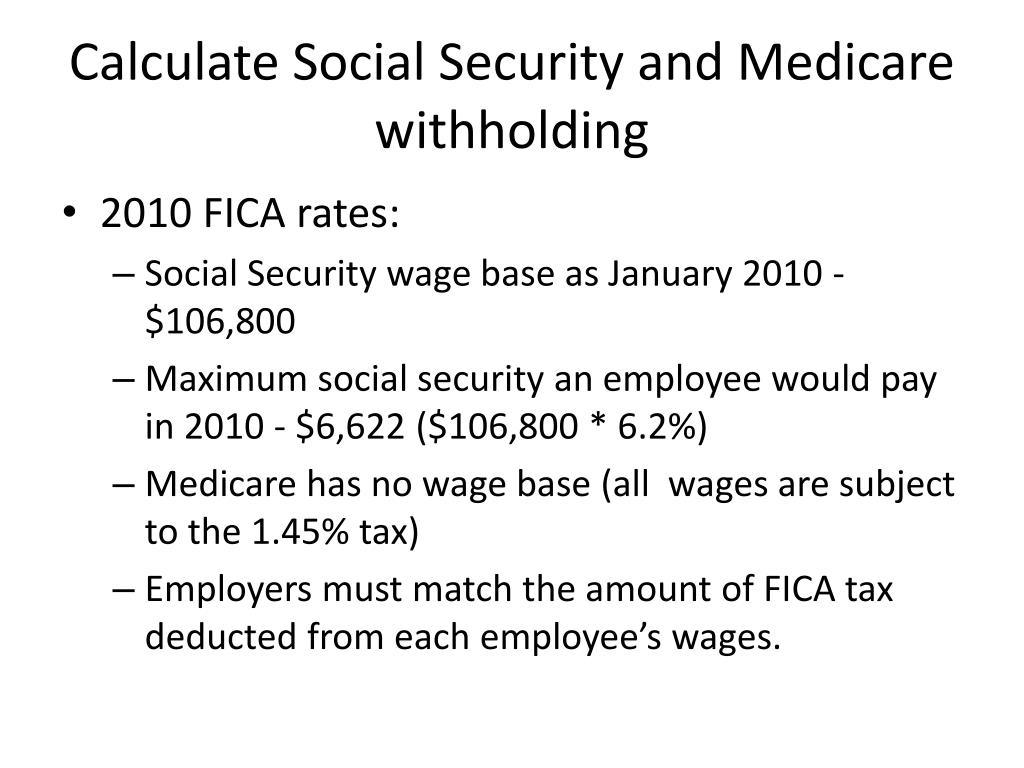

Employer Social Security Tax Rate 2025 Maggee, However, the employee and employer each pay 6.2% for social security and. Fica tax is a mandatory payroll tax funding social security and medicare programs.

What Are The Current Fica And Medicare Rates, 29 rows tax rates for each social security trust fund. It’s important to note that.

Understanding FICA, Social Security, and Medicare Taxes, However, the employee and employer each pay 6.2% for social security and. Fica tax is a mandatory payroll tax funding social security and medicare programs.

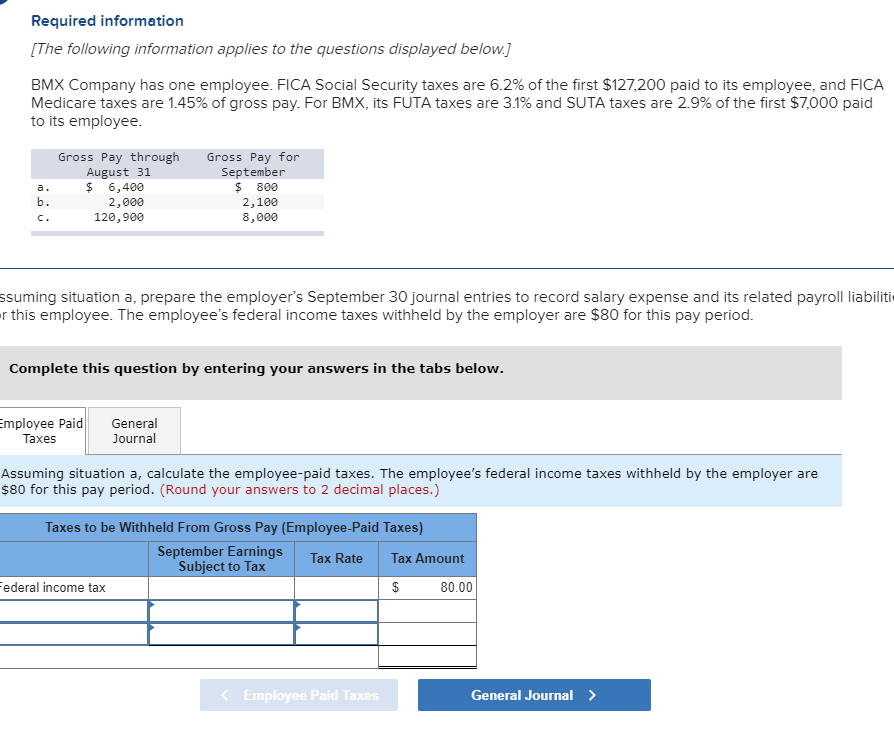

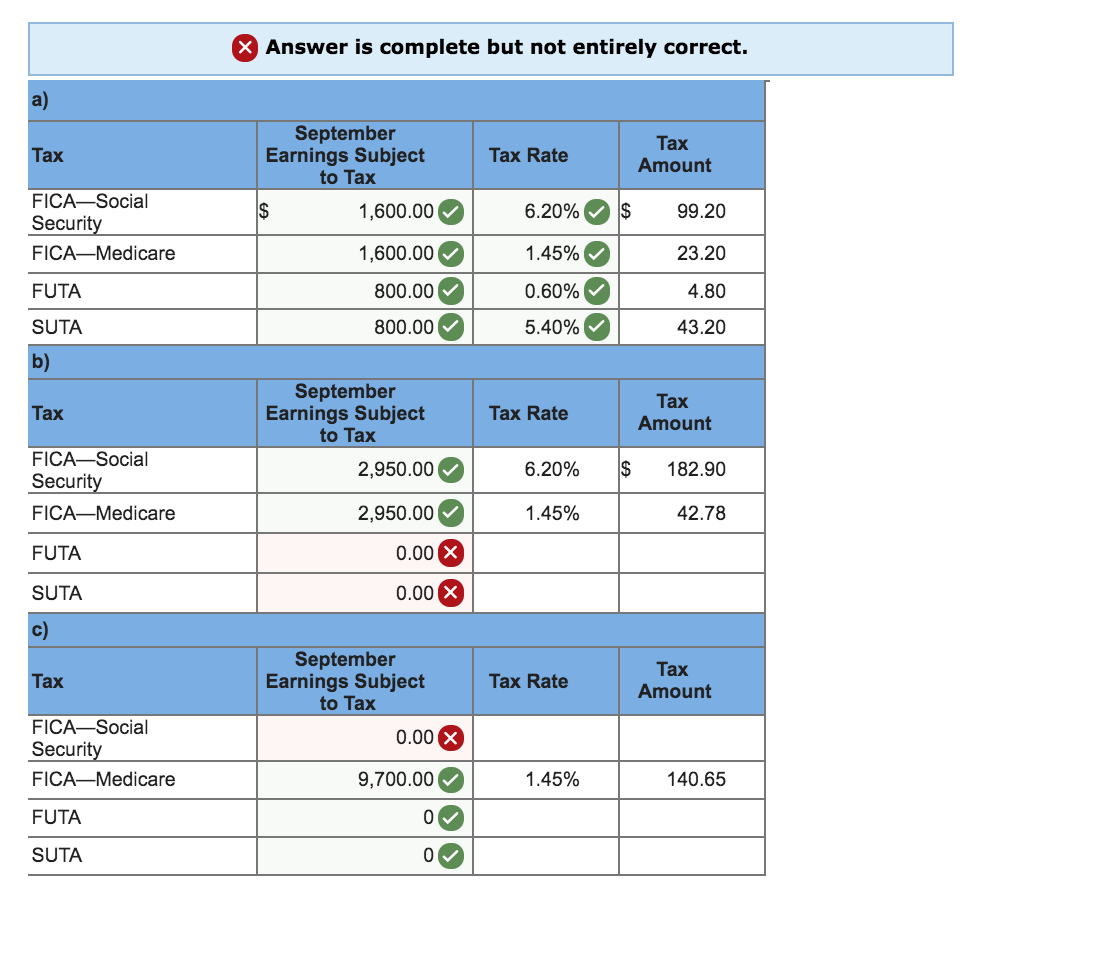

Solved Required information [The following information, It’s important to note that. 1.45 percent medicare tax (the “regular” medicare tax).

2025 Fica Tax Rates And Limits 2025 VGH, Fica taxes have two main parts: As of 2025, the combined rate for social security and medicare taxes under fica is 7.65% for each party (at a total rate of.

Employer rate of 1.45% plus 20% of the employee rate of 1.45%, for a total rate of 1.74% of wages. The 2025 medicare tax rate is 2.9% total.

Answered Required information [The following… bartleby, 1.45 percent medicare tax (the “regular” medicare tax). What is the fica tax rate in 2025?

Fica And Medicare Tax Rates 2025 Adara, It’s important to note that. Federal payroll tax that plays a critical role in funding social security and medicare.

Solved Paloma Co. has four employees. FICA Social Security, In 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2023. As you can see, the employer’s.